T4/T4A Tax Forms Format Profile

The T4/T4A Tax Forms Format Profile contains the printing definitions for generation of the T4 and T4A statement. There are 6 profiles, T4 forms and formats for tax groups 6 through 8 and T4A formats for tax groups 6 through 8. All 6 profile formats must exist within each payroll. When a profile format is missed, just access this option for the applicable T4 or T4A tax group and then exit to create an empty profile format.

The lines of the tax profile are displayed sorted based on line number and column number within each line. The sorting of the profile lines takes place when you exit so the lines will be organized when you enter a profile.

This generation of T4 and T4A's pulls information from the Employer Constants for the applicable tax group. Review and complete all information under the Employer Constants in the database each year before beginning your T4 and T4A's.

This option also allows access and maintenance of up to 5 Alternate profiles format for each of the main 6 tax format profiles for a total of up to 30 tax profile formats. These Alternate profiles are not mandatory. Alternate profiles can be used throughout the T4/T4A processing but are useful for Summary reporting where only those required fields are defined.

When an employee has more than 6 T4 Other Boxes it is required that a second T4 be printed that contains the employee's address and SIN and the remaining Other Boxes to be included.

The requirement for two T4 slips when an employee has more than 6 Other Boxes also applies to the T4 XML record.

Note: The tax group used to define your profile parameters must correspond directly to the Group number used on your actual income tax deduction code.

T4/T4A profiles must be set up before T4/T4A processing can be run.

Tax Group Number

Enter '6' for deduction group 6.

Enter '7' if using the second tax number for deduction group 7.

Enter '8' if using the third tax number for deduction group 8.

T4 Or T4A

Enter 'T4' to access a T4 profile.

Enter 'T4A' to access a T4A profile.

Use Regular or Alternate Profile

Enter 'R' to access the regular T4 or T4A profile.

Enter 'A' to access the Alternate T4 or T4A profile. This allows you to maintain multiple tax formats for the same T4 or T4A tax group. The Alternate tax profiles are not required and are only used if you want an Alternate profile with different print definitions to be used for exporting information while at the same time not affecting the definitions on your main T4 or T4A profile. You can also define alternate print positions to be used for generation of the employer copy when T4 self-sealers are used.

When 'A'lternate profile was selected:

Enter Alternate Profile Code

Enter a letter from A to E to be used in the naming of the Alternate tax profile.

The name of the Alternate profile is the same as the main profile except the profile code you entered (A-E) is in the 4th position. For example, PRØØ6F.DAT is the main profile for T4 tax group 6 and PR0A6F.DAT or PR0C6F.DAT could be the Alternate profiles name. All T4 and T4A profiles are maintained at the location defined by the logical SRB$OPSPRO.

The first time you access an Alternate Tax Profile (that does not already exist) you are given the option to copy the profile parameters from the original tax profile into the Alternate Tax Profile.

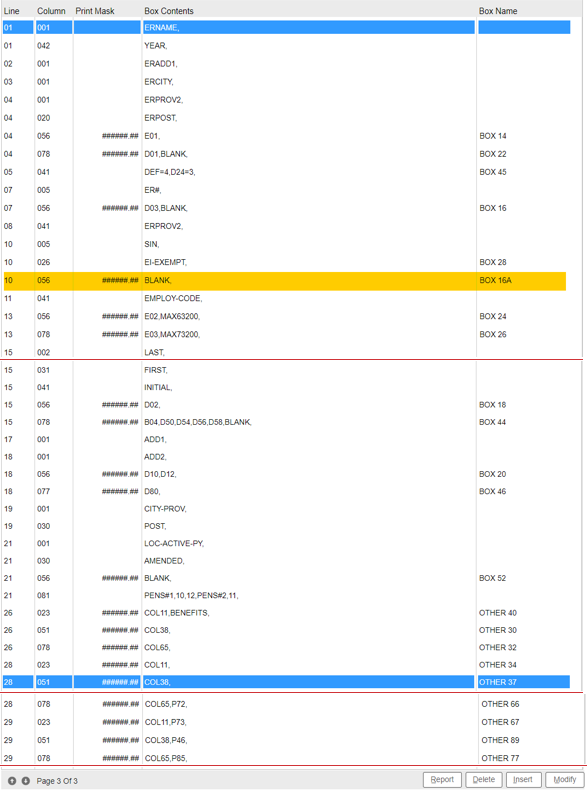

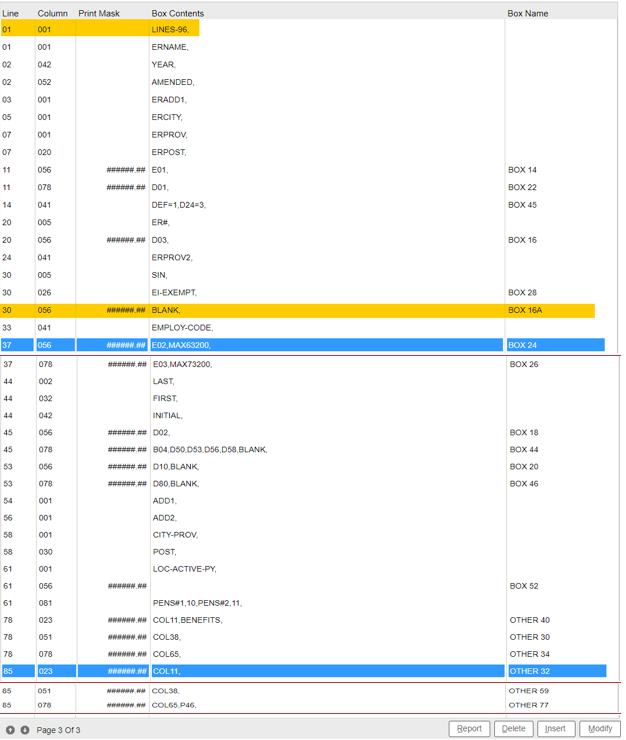

The example above includes the estimated print positions for the 2023 32-line T4 form including the new BOX 16A effective as of 2024.

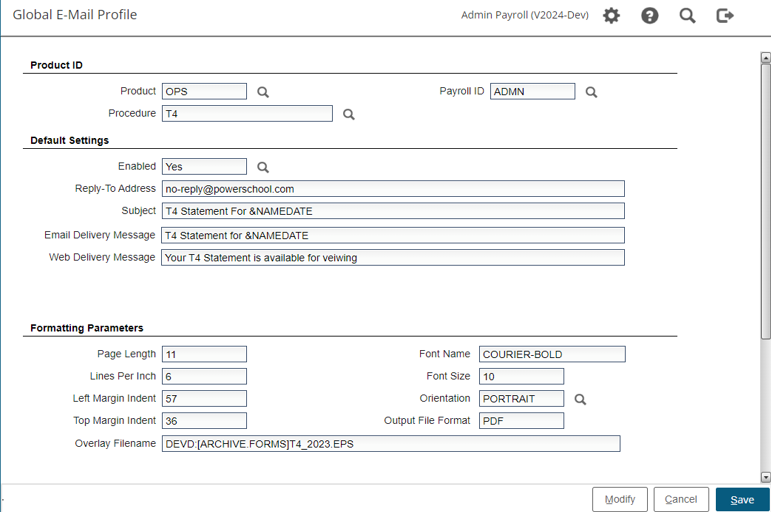

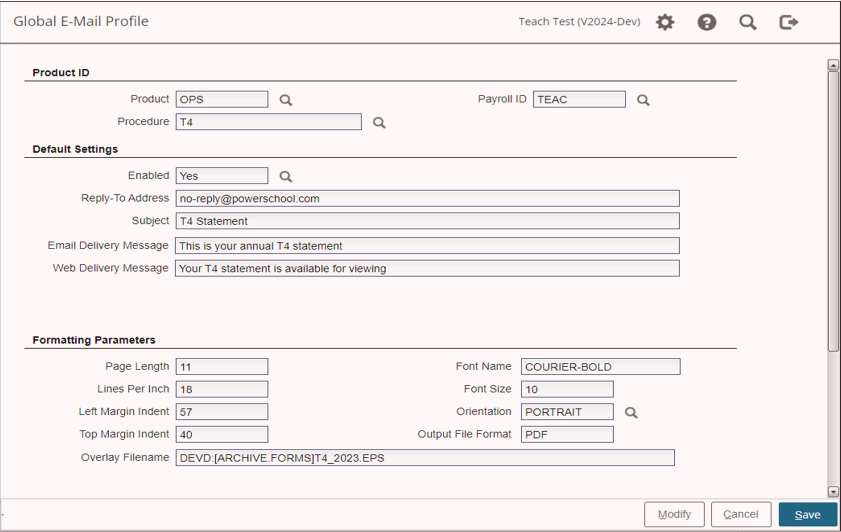

The following screen includes the applicable parameters to define the 2023 T4 overlay to be used with the Emailing or Web viewing T4 option. This definition would be defined under the Global Email Profile per payroll.

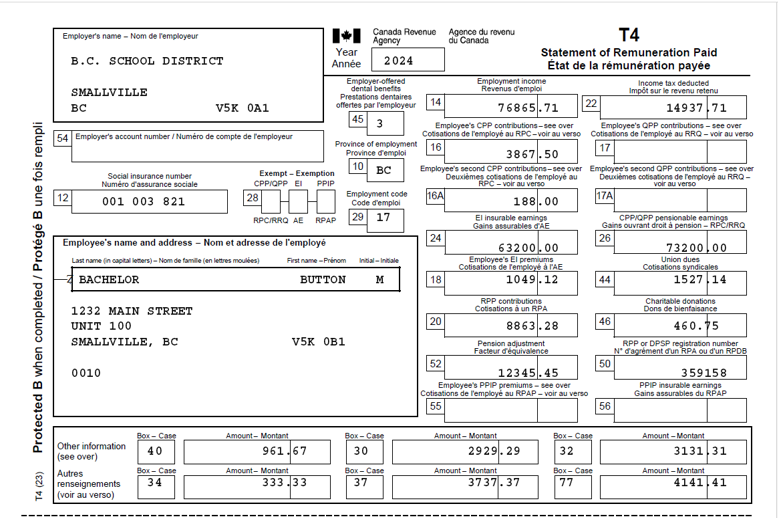

The above print parameters and global email settings produce the follow results for 32 lines per page T4.

The full T4/T4A back page can be included on the PDF T4 document, and this is optional during the generation of T4/T4A. For the T4A due to space limitations, you select to include either English or French back page.

The following are print positions for a 96-line T4. By extending the number of lines per page, you can have better control over the print positions per box. This is completely at your discretion. It is recommended if you use the extended line per page, you define on the profile the LINES-## for example, LINES-96, as highlighted. This will ensure the T4 creation and regeneration will default to 96 lines per page automatically when you run using this profile setting.

The following screen includes the applicable parameters to define the 2023 T4 overlay to be used with the Emailing or Web viewing T4 option for the 96 lines option. This definition would be defined under the Global Email Profile per payroll.

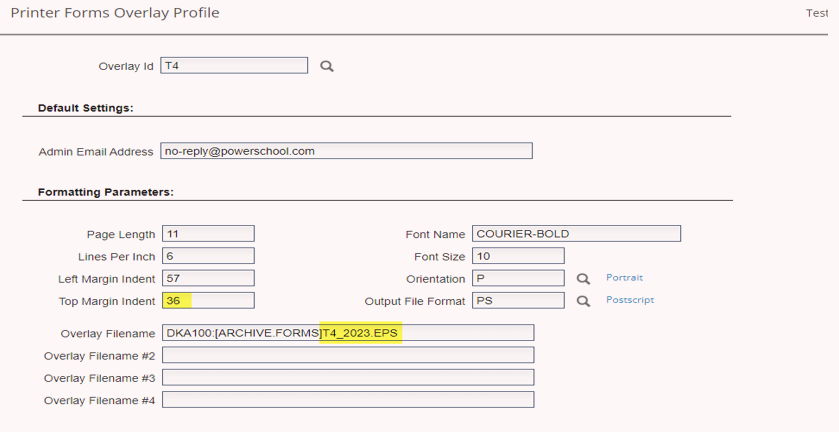

The following screen includes the applicable parameters to define the 32-line 2023 T4 overlay to be used with the overlay printing T4 option. This definition would be defined under the Printer Forms Overlay Profile in the SMS system.

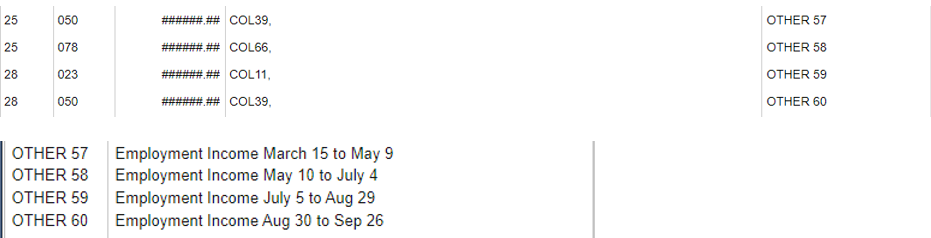

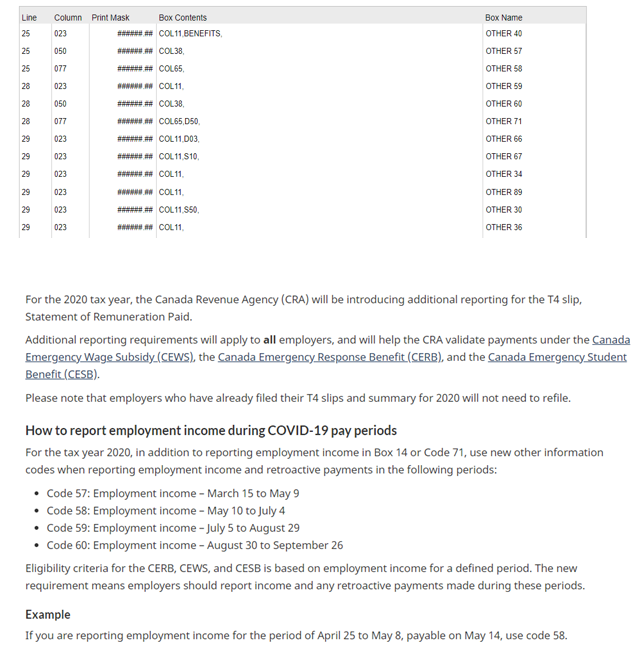

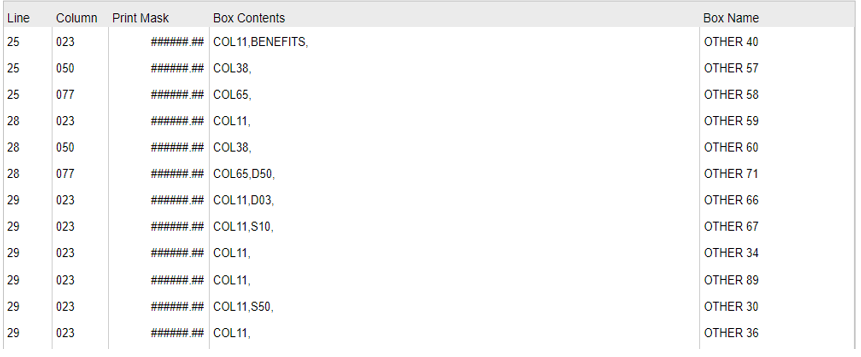

Note: 4 Other box categories are required for the 2020 taxation year (only) which will detail the employee’s Box 14 earnings for the predefined date ranges, as shown below.

Define the 2020 year OTHER 57 thru to OTHER 60 boxes with only the COL## defined in the content field. The T4 process automatically defines the date ranges and pulls the Content definition from the current Box 14 definition. The T4 Creation process will read through the payroll calendars using the Cheque Date per payroll calendar entry to determine which period of Box 14 values will be accumulated per OTHER code. A list of pay periods used per OTHER 57 – 60 codes will appear in the T4 Creation log.

Due to the 4 mandatory Covid earnings in 2020 Other Boxes, there may be a condition where you need to define more than 6 Other Boxes for T4 reporting. The T4 processing will use the print positions from the first six Other Boxes for the second set of Other Boxes. Based on that the print positions are not valid for any T4 Other Boxes after the first 6. It is recommended you use line 29 or 30 and the same column number for all additional T4 Other Boxes.

Do not define a line past line 32 for any T4 using the 32 lines per page.

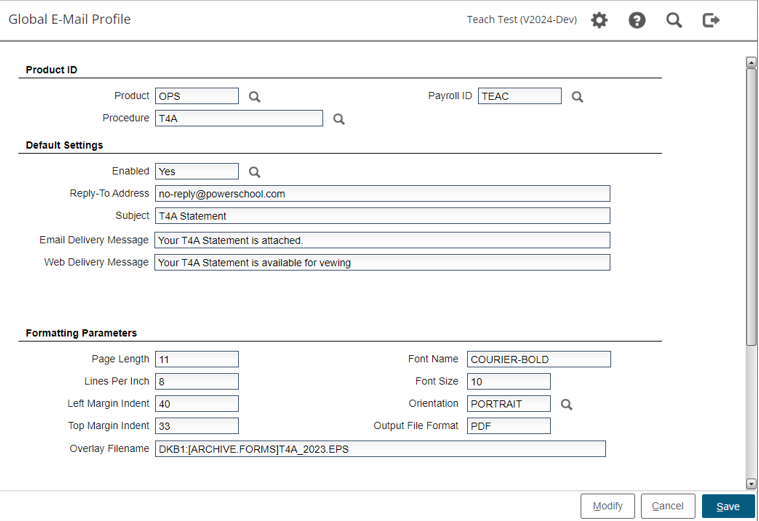

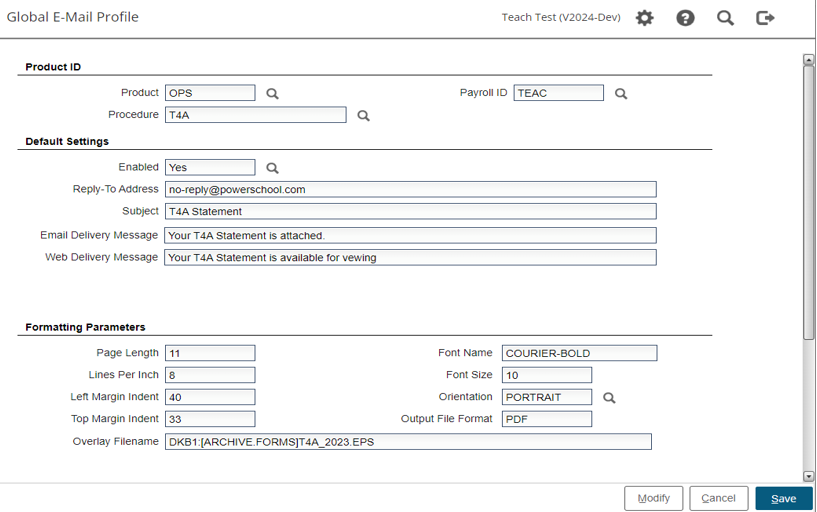

The following screen includes the applicable parameters to define the 2023 or newer T4A overlay to be used with the Emailing or Web viewing T4A option. This definition would be defined under the Global Email Profile per payroll.

The following screen includes the applicable parameters to define the 2023 T4A overlay to be used with the overlay printing T4A option. This definition would be defined under the Printer Forms Overlay Profile in the SMS system

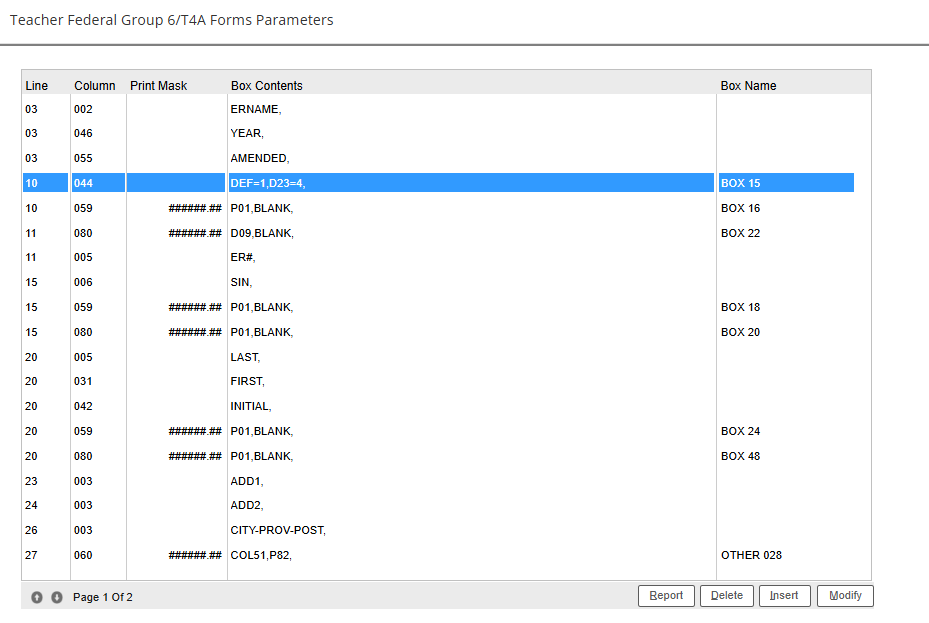

The example above includes the estimated print positions for the 2023 T4A overlay form.

The vertical menu bar displays your options. Use the left and right arrows to move to an option or enter the highlighted character to access that option. Use the up and down arrows as well as the page up and page down keys to access different lines and pages within the tax profile.

Exit

Enter 'E' to exit back to the menu. All changes made to the profile will be saved.

Add

Enter 'A' to add a new line to the tax profile. A new line will be generated right above where the cursor is currently displayed.

Save

Select the 'Save' button to exit back to the menu. All changes made to the profile will be saved.

Cancel

Select the 'Cancel' button to exit back to the menu.

Insert

Select the 'Insert' button to add a new line to the tax profile. A new line will be generated right above where the cursor is currently displayed.

Modify

Select the 'Modify' button to modify the line currently pointed to by the cursor.

Delete

Select the 'Delete' button to delete the line currently pointed to by the cursor.

Report

Select the 'Report' button to generate a report of the current tax profile.

Refresh

The refresh option is only available for Alternate profile parameters.

Select the 'Refresh' button to reset the Alternate tax profile to the definitions from the original tax profile for this T4 or T4A and applicable tax group.

While Adding or Modifying a line you have the option to use the <Up> and <Down> arrows (as well as <Enter>) to move between fields. The fields are to be completed as follows:

LL Enter the vertical line on which the box being defined is located on the actual form.

PPS Enter the column number to define the starting print position for this line item.

PRINT MASK The print mask defines the size and display for numeric values. The print mask should be left empty for non-numeric values. Valid characters are: '#' to represent a digit, a ',' to separate thousands etc., and the '.' to print a decimal point. The maximum mask size is a total of 10 positions.

The following are examples of how the mask may be defined. Any variation and length of these is permitted.

###,###.## - with comma and decimal

#######.## - with only decimal

########## - with no cents

Box Contents

Box Contents defines what is to be printed. The Box Contents field allows entries of up to 100 characters. Values entered in this field are validated to ensure the field values will be accepted by the T4/T4A statement process.

The following character key words (if non-numeric no mask should be entered) can be used. These key words must be entered exactly as shown:

Lines-## defines the default number of lines per page to be used during the T4 generation

ERNAME prints the employer's name 1 from the employer's constants

ERADD1 prints the 30 characters of address line 1 from the employer's constants

ERADD2 prints the 30 characters of address line 2 from the employer's constants

ERCITY prints the city from the employer's constants

ERPOST prints the postal code from the employer's constants

ERPROV prints the province name from the employer's constants

ERPROV2 prints the two character province code from the employer's constants. This value is used for the province of employment

ER# prints the Payroll Account Number from employer's constants; this should be your nine digit business number, two-letter program identifier, and a four-digit reference number.

ERCOUNTRY prints the employer's country from the employer's constants

YEAR prints the four digit taxation year. This is defined when the T4/T4A Statement Processing is run

AMENDED prints the word AMENDED at the position defined, will only be applied to statements generated when the T4/T4A Amended Statement Processing is run. Will be omitted on regular statements.

SIN prints the employee's SIN

EMP# prints the employee number

LAST prints employee's last name

FIRST prints the employee's first name

MIDDLE prints the employee's middle name

INITIAL prints the employee's middle initial

FNAME prints the employee's last first and middle names WITHOUT spaces

FIRST-MIDDLE prints the first name, one space and then the middle name

ADD1 prints the first line of the employee's address

ADD2 prints the second line of the employee's address

ADDS prints address line 1 and address line 2 joined together. Extra spaces are removed. Using this address line option eliminates the blank line for employees without an address line 2

City prints the employee's city

PROV prints the province from employee's province field

PROV2 prints the long form of the province based on the value in the employee's province field

POST prints the employee's postal code

City-PROV prints the city, a comma and the province code

City-PROV2 prints the city, a comma and the province in full

City-PROV-POST prints the city, a comma, the province code, a space and the postal code

City-PROV2-POST prints the city, a comma, the province in full, a space and the postal code

COUNTRY prints the employee's country

LOC prints the employee's location code

LOC-A prints the location code only on the address label (3rd section) of the self sealer

LOC-ACTIVE-EE prints the location code for active employees ONLY. Terminated, On Leave and On Leave With Benefits employees will not have location codes printed

LOC-ACTIVE-EE-A prints the location code for active employees ONLY and only prints on the address label (3rd section) of the self sealer. Terminated, On Leave and On Leave With Benefits employees will not have location codes printed.

LOC-ACTIVE-ED prints the location description for active employees ONLY. Terminated, On Leave and On Leave With Benefits employees will not have location description printed.

LOC-ACTIVE-ED-A prints the location description for active employees ONLY and only prints on the address label (3rd section) of the self sealer. Terminated, On Leave and On Leave With Benefits employees will not have location description printed.

LOC-ACTIVE-PY prints the location code from the current payroll for active employees. For inactive employees, Terminated, On Leave and On Leave With Benefits, the system will look for a location code on other payrolls where the employee is active. If the employee is not active on any payroll, or the employee is only on this current payroll, the location code will not be printed.

LOC-ACTIVE-PY-A prints the location code from the current payroll for active employees only on the address label (3rd section) of the self sealer. . For inactive employees, Terminated, On Leave and On Leave With Benefits, the system will look for a location code on other payrolls where the employee is active. If the employee is not active on any payroll, or the employee is only on this current payroll, the location code will not be printed.

EMPLOY-CODE defined the print position for the employment code for Box 29. The value of the employment code must be defined through the T4 Statement Maintenance process.

PENS#1,##,##,.. prints pension ID number (taken from the Registration field on the deduction code database for GROUP 1 deductions only) for any valid pension deduction the employee may have. ##,##,... is the list of possible pension deduction codes any employee may have. The registration number must be all numeric and cannot exceed 7 digits

PENS#2 prints second pension number the employee may have

PENS#3 prints third pension number the employee may have

SEQUENCE# prints the payroll ID followed by a 4 digit sequential number, for example, TEACØØØ1. This is not required by CRA but may be used for your own management of the T4/T4A forms

T4's ONLY

VOW OF PERPETUAL POVERTY

The 1998 T4 form did not include a means of reporting this information. When CRA was contacted they suggested a message be printed somewhere on the form. The following CONTENTS code was generated to accommodate the print position definitions and reporting of the VOPP message on the T4's.

Enter VOPP: followed by the applicable message, for example: VOPP:VOW OF PERPETUAL PROVERTY TAKEN.

When this has been defined on a T4 tax form parameter the message will only be printed when the employees VOPP has been set to 'Y' on the employee's master pay screen.

EI-EXEMPT

For Box 28 on T4's only you may indicate that the EI Exempt flag should be marked automatically when the employee's Box 14 equals Other 40 and Box 18 is zero. This combination indicates the employee had no EI and the full Box 14 amount is a taxable benefit with no EI implications. The employee's EI exemption box will be marked with an X and a message will be included when the T4 is created or regenerated. Should the employee's EI exemption flag already be active based on the employee's pay master screen, no message will be displayed.

MAX######,##

As of 2011 tax year: For BOX 24 (EI Insurable Earnings) and BOX 26 (CPP Pensionable Earnings) on T4's ONLY you would include this code word MAX immediately followed by the maximum insurable/pensionable earnings for the applicable tax year, for example, MAX44200 on BOX 24 and MAX48300 on BOX 26. These values must be checked and adjusted each tax year before starting the T4 processing.

The addition of this code word will cause the T4 create process to cap the BOX 24 and BOX 26 earnings based on the MAX amount defined. As of the 2011 tax year these two boxes are always to be reported but only up to the applicable yearly limit, and to be reported as zero when no earnings are applicable. The MAX is not applied during the regeneration process. The T4 Merge Creation process will also cap the combined CPP Earnings and EI Insurable when the code MAX is defined in the profile used during the merge run. All capped earnings are reported in the log of the process.

The following code combinations are valid in the BOX CONTENTS for T4 and T4A fields in order to define the criteria of each box amount:

Where ## is the pay or deduction code to use and

Where X is one of the following:

P Pay Code Amounts

D Deduction Amounts

S Employer Share Amount

E Deduction Eligible Amounts. It is recommended that the income tax eligible, (E##) be used for the definition of Box 14 on T4 when multiple T4 income deductions exist on a payroll

B Taxable Benefit Amounts

X##-##, defines a range of codes

X##,X##, defines multiple specific codes

-X##, defines a code amount to be subtracted.

Examples:

P01, Add the value of Pay Code 01

-D02, Subtract value of Deduction Code 02

S01-04, Add the value of the employer's share of deduction codes 01 to 04

-E05-08, Subtract the value of the eligible earnings of deduction codes 05 through to 08

D02,D03,D04, Add the values of deduction code 02, 03 and 04

B10,B30, Add the values of the taxable benefits from deduction codes 10 and 30

The following code words may be used in conjunction with the numeric formula definitions:

BENEFITS This code adds the value of all the taxable benefits to the box amount

BLANK This code leaves the box contents empty instead of 0.00 for the box when the value is zero. As of 2011 tax year, this code should not be used on BOX 24 nor BOX 26.

BOX14 This code leaves the contents of the box empty when the box total equals the value defined for BOX 14. A BOX 14 line must be defined when this option is used. As of 2011 tax year, this code should not be used on BOX 24 nor BOX 26.

Note: Follow all codes with a comma

Keywords must be spelled as shown

Examples:

BENEFITS,-S10,-S20, BLANK,

This uses all of the taxable benefits and subtracts the employer's share of deduction codes 10 and 20. If the box total is zero, BLANK will leave the box empty instead of printing 0.00.

P01-25,S20-30,S45,

This uses pay code amounts from 01 to 25, then adds the employer's share from deduction codes 20 to 30 as well as the employer's share from deduction 45.

E01

Print the total taxable eligible earnings when the deduction code is the T4 income tax deduction. The use of the income tax eligible earnings for the generation of Box 14 (Employment income) is recommended especially for payrolls with multiple T4 income tax deductions. The T4 Tax Eligible Reconciliation would be used to verify all income tax eligible amounts.

E03,

This is used to print the CPP eligible earnings.

The BOX14 reference means that when the total in this box is equal to the amount in the box with 'BOX 14' in the name field, it will leave this box blank. NOTE: 'This blank if equal to BOX 14' may only be done with BOX 14. As of 2011 tax year, the BOX14 code should not be used on BOX24 nor BOX 26

Box Name

The Box Name column is to be filled in only on boxes that contain numeric data to be summed up in the totals and sub-totals, with the exception of BOX 28 on T4's. Leave the name field blank for other field types. One box must have the name BOX 14 if the keyword BOX14 was used in any of the box contents fields. Each numeric field MUST has a corresponding box number. All the boxes do not need to be used. The box name MUST be entered as shown:

Valid box names for T4A's as per 2024 taxation year:

BOX 16 - Pension or superannuation

BOX 18 - Lump-sum payments

BOX 20 - Self-employed commission

BOX 22 - Income tax deducted

BOX 24 - Annuities

BOX 48 - Fees for services

OTHER ### - other codes and amounts including employee # code 014 and pension registration number code 036

Valid box names for T4s as per 2024 taxation year:

BOX 14 - Employment income

BOX 16 - Employee's CPP Contributions

BOX 16A - Employee's CPP2 portion of CPP contributions

BOX 18 - Employee's EI Contributions

BOX 20 - RPP Contributions

BOX 22 - Income Tax deducted

BOX 24 - EI Insurable Earnings

BOX 26 - CPP Pensionable Earnings

BOX 28 - Print position for CPP/EI Exempt

BOX 44 - Union dues

BOX 45 - Employer-offered Dental Benefits code

BOX 46 - Charitable donations

BOX 52 - Pension Adjustment (PA)

OTHER ## - Other codes and other amounts

BOX 52 (T4's) or OTHER 034 (T4A's) for the pension adjustment does not require a value to be entered in the box contents field. The PA value used is taken from the separately entered values from the Pension Adjustments Menu.

BOX 28 - Exempt CPP and EI need only be defined with a print position. The employee’s pay screen Field CPP/EI EXEMPT determines when an 'X' is to be printed on the T4. When an employee’s CPP exemption has been set to ‘Y’es and the CPP Exempt Effective date has been completed, the CPP effective date must be for a prior year from the taxation year being reported in order for the T4 process to flag the Box28 CPP Exemption box. When the employee’s CPP exemption is set to ‘Y’es and no effective date is entered, the T4 process will flag the Box28 CPP Exemption.

BOX 45 - As of 2023, Box 45 Employer-Offered Dental Benefits for T4s is a required field. This box should report the level of Dental Benefits Access an employee had as of December 31st of the taxation year. You report the employee’s dental access code regardless of whether an individual has made use of the benefits, the reporting defines if the employee had access to this benefit.

For T4s, the reporting is mandatory and is represented by a numeric digit from 1 to 5 where:

1 = Employee has no access to any dental benefits

2 = Employee only

3 = Employee, spouse, and dependents

4 = Employee and spouse

5 = Employee and dependents

Dental Box 15 for T4As reporting is only mandatory if there is a value in Box16.

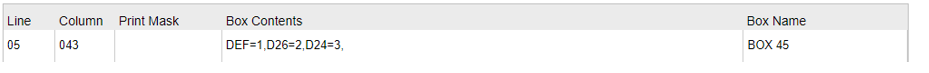

Example of profile entry for T4 Box 45 or T4A Box 15:

Where: DEF=1 identifies the default dental code of 1 is to be used for those employees who do not have one of the listed deductions, or the deduction was not applicable as of December 31 of the taxation year. D26= 2 indicates those employees with deduction 26 on their deduction master will be assigned dental code 2, D24=3 will assign dental code 3 for those employees with deduction 24 on their deduction master. The deductions are as at the time the T4/T4A processing is run. The process will use the first deduction found on the employee’s master based on the order the deductions are defined in this profile. This process uses the deductions as defined on the employee deduction master and as such for employees who were entitled but waived the dental benefit, you would need to add a dental deduction code to the employee’s master to trigger the correct T4 reporting. For those situations you can suspend the employee’s deduction or define a deduction table for those waiving the benefit with no deduction amount.

You can also define the dental BOX 45 as simply DEF=3 if you want all employees to receive the dental benefit code of 3.

An employee who was terminated prior to December 31st of the taxation year will be set with the Default benefit code. The T4 process will review the employee’s deduction end period value to determine if the employee’s dental deduction was active beyond the termination date. In that case the dental code assigned to the dental deduction will be applied.

If the starting pay period on the deduction represents a date after December 31 of the taxation year, that deduction will be skipped and the next deduction in the list will be checked, per employee.

If no profile element for Dental is setup for Box 45 on the T4, then all employees will be reported as code 1 in the XML sent to CRA. With no print positions defined for Box 45, nothing will be printed on the actual T4 form.

If no profile element for the dental benefit is setup for Box 15 on the T4A, the reporting of the dental access field will be omitted on the T4A XML to be sent to CRA.

The dental benefit code can be edited in T4/T4A Statement Maintenance for both regular and merged T4/T4As for any employee, as needed.

Other Boxes:

The OTHER boxes are defined at the line and print position where the numeric value should be printed. The MASK defines the size of the numeric to be printed. No MASK should be included on non-numeric OTHER CODES such as T4A OTHER 014 Employee Number and OTHER 036 Pension Registration Number. The first item in the contents field MUST BE the column position where the OTHER CODE will be printed. Define enough OTHER sets to cover all possibilities for the payroll. You may define more than six for T4s and twelve for T4As OTHER set, although one employee may not have more than six/twelve OTHER sets. When the T4/T4A processing is run only those OTHER sets that apply to an employee will be printed. An employee's OTHER sets will be printed using the print positions in order based on line and column, regardless of the actual OTHER CODE value being printed.

For example:

28 019 #####.## COL09,S41,S42,S34, OTHER 40

28 042 #####.## COL27,B64,B65, OTHER 31

These two lines define the criteria that make up OTHER 40 and OTHER 31. If an employee has values based on both of these definitions, then code 40 will be printed at column 9 on line 28 and the other amount will be printed at column 19 on line 28. The code 31 will be printed at column 27 on line 28 and the amount at column 42 on line 28.

When an employee only has OTHER 31 then code 31 and corresponding amount will print in the first print position, column 9 line 28 for code 31 and column 19 line 28 for the other 31 amount.

The T4 reporting only uses the printing positions from the first 6 T4 Other Boxes. When there is a need to define more than 6 Other Boxes the T4 processing will use the print positions from the first 6 Other Boxes for the second set of Other Boxes. Based on that the print positions are not valid for any T4 Other Boxes after the first 6. It is recommended you use line 29 or 30 and the same column number for all additional T4 Other Boxes.

Do not define a line past line 32 for any T4.

Note: The Payroll system does not validate the OTHER CODES. Other Codes are defined by CRA and subject to change. Refer to the Employers Guide to Payroll Deductions for the correct OTHER CODES to be used.